Paytm’s Payments Bank has been operating since May 23, 2017. Initially, It was available on an invite-only basis but with the new Paytm app V6.0.0, released on August 30, 2017, it is now available to every Paytm user in India. There is no separate App required to use the Paytm Payments Bank as it’s integrated in the same Paytm recharge and Wallet app. Once you upgrade your Paytm app you will see a new Payment Bank option flashing on the top. With the launch of Paytm Payments Bank, India has got four of such Payments Bank now. Airtel was the first entity to launch such Payments Bank services in India followed by India Post Payments Bank, Paytm Payments Bank, and FINO Payments Bank. Two other big players – Aditya Birla Nuvo and Reliance Industries have also got the RBI’s nod to open Payments Bank and they will also be added in the list soon.

| Paytm Payments Bank is here |

Paytm is planning to expand its banking business by adding 31 new branches and 3000 customer service points as told by the company’s spokesperson earlier. There is no doubt that Paytm is going to make the most of Payments bank services due to its huge customer base who regularly do online recharge and shopping. After the demonetization policy, Paytm has got the significant spike in the number of its app users and the transactions carried out through its app. As a result of this, the Paytm Wallet is being accepted by almost every merchant even big companies like Facebook, IRCTC and UBER Taxi have been accepting payments from Paytm wallets. Having said that, it’s sure that Paytm is going to build a new business model in digital banking sector and the company’s aim to raise its valuation to $100 billion by the year 2025 is more likely be achieved. Paytm has recently launched its bill payments services in Canada as a part of its expansion plan. So, let me explain to you what Payments Bank is and how the Paytm Payments Bank is different from others.

You may also like to read : Tez – A new Payment app by Google

What is Payments Bank?

Payments Bank is a new banking model conceptualized by the Reserve Bank of India. As the name suggests, Payment banks are not a substitute for the old traditional banks. They have limitation in accepting the sum of money which is currently capped to ₹1,00,000 per customer. Which means, at any given time a customer can’t have the total account balance more than ₹1,00,000/-.

Payments Bank is also not permitted to lend or offer credit card, loans, overdrafts/advances facility, demat accounts, term deposits, recurring deposits, PPF accounts etc. In case they want to offer such products, they will have to partner with traditional banking or financial entity.

They can only offer or issue savings account, current account, cheque books, and debit cards with net-banking, mobile-banking and bill payment facility. With the advent of Payment Banks, every citizen of India can easily access the banking services and use it for sending or receiving money, cash withdrawal, online recharge and utility bill payment, booking movies and travel tickets, paying for school fees or shopping online etc.

What are the key features of Paytm Payments Bank?

#1. It’s offering a zero balance Savings Account with no account opening charges.

#2. Keeping money in Payments Bank account instead of Paytm Wallet earns you an interest of 4% per annum which is paid every month. It’s a simple 2 minutes procedure to open Savings account and your Paytm login credentials and wallet balance will continue to function in the same manner as earlier.

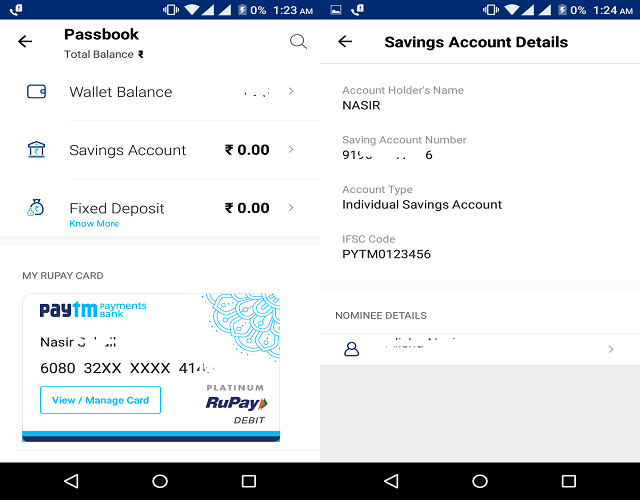

#3. You get a free virtual RuPay debit card to make online purchases. They will soon be offering a physical debit card at an annual fee of ₹100 which you will be notified of. Physical RuPay debit card also comes with an insurance cover of up to Rs. 2 lacs in the event of death or permanent total disability as per the terms and conditions.

#4. Account is safe and secure with an additional 4-digit app passcode. You also get the option to block/unblock you debit card from withing the Paytm app.

#5. Unlimited free online funds transfer to another Paytm Payments Bank account or Paytm wallet.

#6. Send and receive money online to and from any bank account in India.

#7. Nomination facility is also available for both savings and current account.

#8. Free Unlimited IMPS, UPI, NEFT and Mobile banking transactions.

#9. If your total Paytm balance( Balance in Wallet and Savings account) exceeds ₹1 Lakh then Paytm will automatically create a Fixed deposit of the exceeded amount in partnership with IndusInd Bank Ltd which yields an interest of 6.85% (compounded quarterly).

#10. Instant redemption with zero penalty on redemption of Fixed deposits before the 13 months of maturity period.

#11. Easy to remember bank account number and IFSC code for remittances. Your Mobile number is your your bank account number prefixed with country code and all the accounts have same IFSC code : PYTM0123456 as of writing. So if your registered mobile number is 9966554433 then your Paytm Payments Bank A/C No. would be 919966554433.

#12. Free online passbook and monthly e-statement which are updated on real time basis.

#13. RuPay card has 5% cash back offer(capped at Rs. 50/month) on utility bill payments and a flat Rs. 25 cashback on irctc.co.in for train tickets booking. NPCI keeps offering cashback and other benefits for RuPay card users which are updated here.

#14. Paytm is planning to launch soon a range of other financial services such as Loans, Insurance, Mutual Funds etc. offered by its banking and financial partners.

Drawbacks of Paytm Payments Bank:

1. Savings account does not give you the option to add or pull money from other account using debit/Credit card as available in wallet. You can either deposit the money at Bank branch, customer service outlet or transfer the money using IMPS or NEFT from another bank account.

2. 3% Processing fee is charged for funds transfer from wallet to Savings account.

3. Interest on savings account is lower as compared to 7.25% offered by Airtel Payments Bank and 5.5% offered by India Post Payments Bank.

4. RuPay debit card offered by Paytm Payments bank can only be used domestically in India.

5. Debit card, Cheque book, lost card replacement, Demand Draft and physical statements are not free and available on chargeable basis just like other banks.

6. Only 3 free ATM withdrawals are allowed in Metro cities while 5 for non metro post which ₹20/ txn will be charged.

7. It has got only one operating branch as of now which is located in Noida.

8. UPI Payment service is not operational as of writing but will be available soon.

9. Payments Bank feature is only available for App and can not be accessed from webpage.

9. Cash deposit and withdrawal at Bank branch can only be done by account holder and he has to carry a proof of identity while depositing or withdrawing cash.

How to open Savings account with Paytm Payments Bank Ltd?

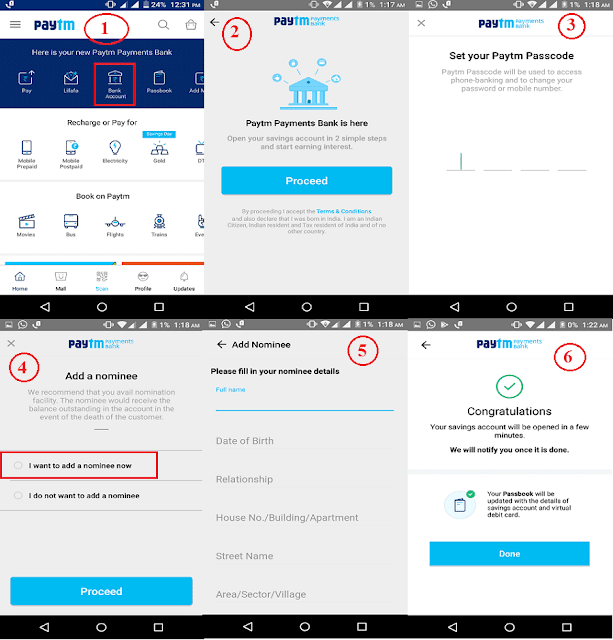

Earlier Paytm users had to request an invite to open an account with Paytm Payments bank Ltd (PPBL) but the new Paytm app V6.0.0 has made it simple. Here are the steps to open Savings account with Paytm Payments Bank.

|

| Savings Account opening Procedure for KYC Customer in Paytm App |

- You just need to update your app if haven’t done so or download the latest version of App.

- Open the App and click on Savings Bank Account icon from main menu in upper section.

- Read the terms and condition and click on Proceed.

- Create a new Passcode and confirm it.

- Enter the Nominee details if you wish to add other wise select “I do not want to add nominee” and click on Proceed.

- If you had already completed your KYC for Paytm wallet then your Savings Account will be created immediately and you will be sent an email and a text message confirming your Debit Card and A/C no.

- When you go to the Savings account section again in the app, you will see your free virtual debit card at the bottom.

Debit Card and Savings Account Details after opening Paytm Payments Bank Account - If you haven’t completed your KYC before or signing up for the first time, then you will need to fill in your PAN and Aadhaar No. and wait for a Paytm Respresentative to contact you to complete the verification. You can also visit the Paytm Payments Bank Branch for completing your KYC.

Savings Account opening Procedure for Non- KYC Customer in Paytm App - Just follow the above simple steps to complete your KYC and open a Savings account with PPCL.

How to transfer money from Paytm Payments Bank?

- Transferring money is also simple task. You just need to select the Money Transfer option from the main menu in upper section.

How to transfer money from Paytm Bank Account - Select the transfer type i.e from “Paytm Bank Savings A/c” to other Bank’s A/c or Wallet, or from Paytm Wallet to Any Bank A/c.

- Alternatively you can use your Virtual Debit card to make payments or add money to your Paytm Wallet which will transfer money from Paytm Bank Savings A/c to Paytm Wallet.

Where is the Paytm Bank branch located and what are the services you can avail there?

| Paytm Payments Bank Branch Location |

Following facilities can be availed at Paytm Bank Branch:

- Open Savings A/c (If you don’t have one).

- Complete your KYC

- Money Deposits and Withdrawal from your A/c

- A/c closure request

- Block / Unblock Debit card

- Request for Cheque book and hard copy of Account Statement

- RuPay Debit Card Insurance Claim Processing

Paytm Customer Care (24X7): 011 3399 6699

Paytm Merchant Helpline No: 0120-33663377