Apple Card Named Best in Customer Satisfaction for Fourth Consecutive Year by J.D. Power

The Apple Card has once again been honored as the Best Co-Branded Credit Card for Customer Satisfaction with No Annual Fee by J.D. Power in their 2024 U.S. Credit Card Satisfaction Study. This accolade marks the fourth year in a row that Apple Card, along with its issuer Goldman Sachs, has achieved the top ranking in its segment within the U.S. Credit Card Satisfaction Study. The J.D. Power study evaluates overall customer satisfaction based on several performance categories, including Account Management, Customer Service, and New Account Experience.

Apple Card’s Journey and Features

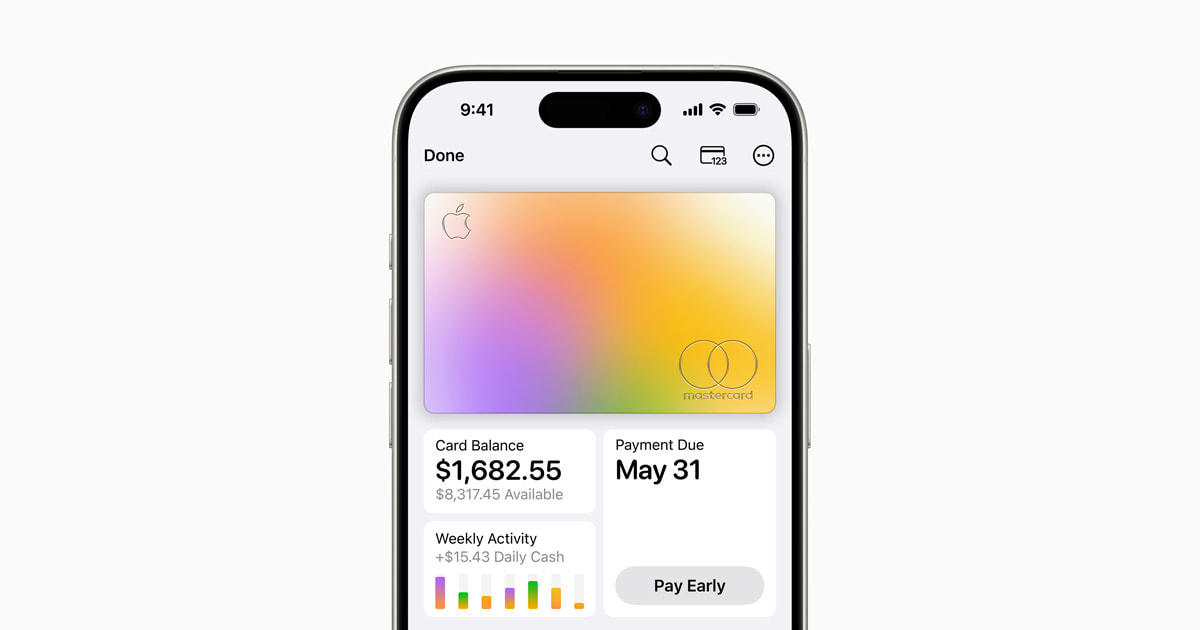

Launched in 2019, the Apple Card was developed with a focus on promoting users’ financial well-being. One of its standout features is the absence of fees, making it an attractive option for cost-conscious consumers. The card is integrated with the Apple Wallet app, providing a seamless, secure method for tracking purchases and managing spending. Users also benefit from up to three percent Daily Cash on every purchase, which can be an enticing feature for those looking to maximize their rewards.

Apple Card Family: Sharing and Savings

Apple Card Family allows users to share their Apple Card account with members of their Family Sharing group, offering a convenient way to manage family finances. Additionally, users can open a Savings account through the Apple Card. This account allows Daily Cash rewards to be automatically deposited, providing an efficient way to grow savings. The Savings account is designed to be user-friendly, with no fees, no minimum deposit requirements, and no minimum balance requirements. Users can also transfer additional funds from a linked bank account to further boost their savings.

Technical Jargon Explained

For readers who might be unfamiliar with some of the technical terms:

- Co-Branded Credit Card: This is a credit card issued by a bank in partnership with a retail company. In this case, the Apple Card is issued by Goldman Sachs in collaboration with Apple.

- Daily Cash: This is a cashback reward system where users earn a percentage of their purchases back in the form of cash.

- Family Sharing: An Apple feature that allows multiple Apple ID users to share access to Apple services and purchases.

Why Apple Card Stands Out

Apple Card distinguishes itself in a crowded market for several reasons. Its integration with the Apple ecosystem makes it incredibly convenient for iPhone users. The ability to monitor spending and track rewards directly through the Wallet app simplifies financial management. Additionally, the Daily Cash feature is a straightforward way for users to earn and use rewards, without the hassle of points or miles.

Moreover, the absence of fees is a significant advantage. Many credit cards come with a plethora of charges, including annual fees, late payment fees, and foreign transaction fees. Apple Card’s fee-free structure removes these potential financial burdens, making it a more accessible option for a broad range of users.

Customer Satisfaction and Industry Recognition

The J.D. Power U.S. Credit Card Satisfaction Study is a respected benchmark in the industry. Achieving the top spot for four consecutive years is a testament to the consistent quality and customer satisfaction that Apple Card and Goldman Sachs offer. This recognition not only underscores the card’s features and benefits but also highlights the exceptional customer service provided.

Reviews and Reactions

The reception of the Apple Card in the market has been largely positive. Many users appreciate its straightforward rewards system and the ease of managing the card through their iPhone. Financial experts often commend the card for its transparency and user-friendly design. However, it’s worth noting that while the Apple Card excels in many areas, it might not be the best fit for everyone. For instance, those who prefer accumulating travel rewards or need extensive international travel benefits might find other cards more suitable.

Additional Information

For those interested in learning more about the Apple Card, detailed information and terms can be found on the official Apple Card webpage at apple.com/apple-card.

Conclusion

The Apple Card’s recognition as the Best Co-Branded Credit Card for Customer Satisfaction with No Annual Fee by J.D. Power for the fourth consecutive year is a significant achievement. It reflects the card’s dedication to providing a high-quality, user-centric financial product. With its no-fee structure, seamless integration with the Apple ecosystem, and straightforward rewards system, the Apple Card continues to set a high standard in the credit card industry.

As the financial landscape evolves, it will be interesting to see how the Apple Card adapts and continues to meet the needs of its users. For now, its ongoing accolades from J.D. Power serve as a strong endorsement of its value and customer satisfaction.

For readers considering a new credit card, the Apple Card offers a compelling mix of benefits and ease of use, particularly for those already embedded in the Apple ecosystem. Whether you are looking to simplify your spending, maximize your rewards, or manage family finances more effectively, the Apple Card presents a robust option worth considering.

—

This article aims to provide a comprehensive overview of the recent accolade awarded to the Apple Card while explaining its features and benefits in an accessible manner. It also touches upon the broader implications and user reactions, offering a well-rounded perspective for readers considering their credit card options.

For more Information, Refer to this article.