In today’s digital marketplace, accuracy in financial dealings is crucial. Even robust platforms like WooCommerce sometimes face small errors, such as tax calculation discrepancies of $0.01 or $0.02. These small errors can create big headaches, especially when dealing with accounting software like Zoho Books. In this article, we explore this common issue, provide an example, and offer a simple fix to ensure tax calculations are accurate and consistent.

Identifying the Problem

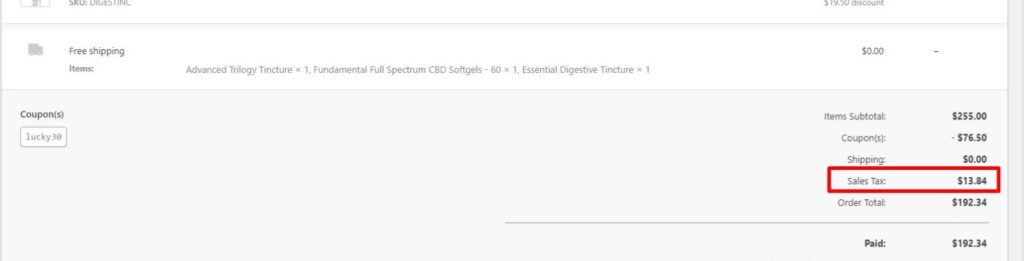

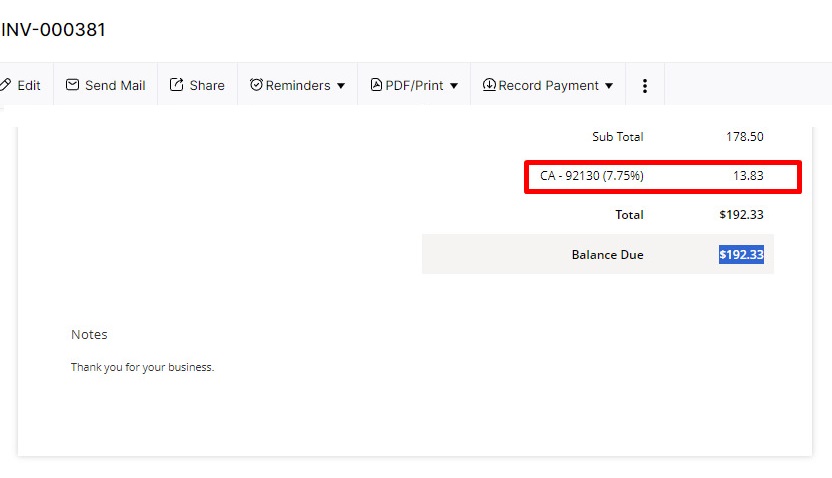

Imagine you’re managing a WooCommerce store and you process an order. The tax calculated for this order is $13.83375, which typically rounds to $13.83. However, WooCommerce rounds it to $13.84 instead. This one-cent difference seems small, but it becomes a significant issue when syncing with Zoho Books, which rounds down to $13.83. This mismatch causes a slight error in the total invoice value, which can block the payment processing in Zoho Books due to its strict rules against overpayments.

Understanding the Cause

The root of this issue lies in how WooCommerce handles tax calculations. By default, it rounds off the tax for each item separately. When added together, these individually rounded figures can differ slightly from the total amount calculated and rounded as a whole.

Implementing a Simple Solution

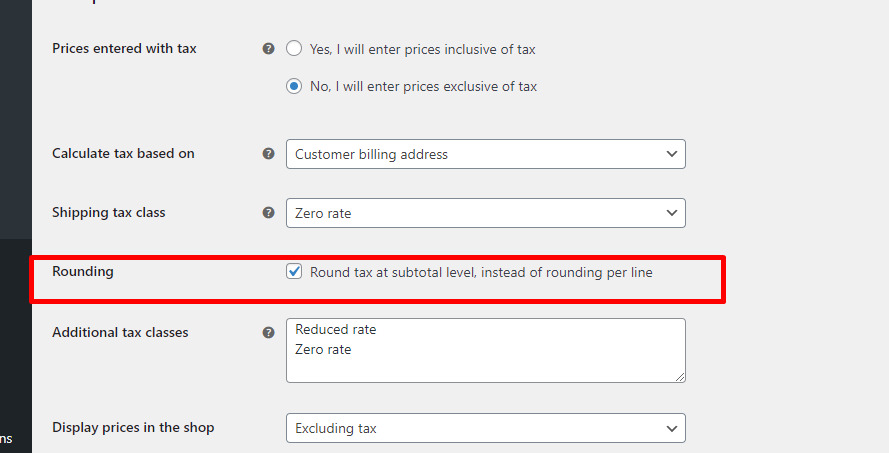

Correcting this rounding problem is straightforward and only requires a small adjustment in the WooCommerce settings:

- Go to WooCommerce Settings:

- Open your WordPress dashboard.

- Click on WooCommerce, then Settings, and finally Tax.

- Change Tax Rounding Settings:

- Find the option “Round tax at subtotal level, instead of rounding per line.”

- Check this box to enable it.

This setting change tells WooCommerce to calculate the total tax for the entire order before rounding, rather than rounding for each item separately. This method ensures the total tax amount matches what would be expected if it were calculated on the total amount directly, reducing discrepancies and aligning with the rounding methods used by accounting systems like Zoho Books.

Conclusion

Integrating WooCommerce with accounting software is essential for keeping accurate financial records in an e-commerce environment. Even small discrepancies in tax calculations can disrupt transaction processes. By understanding and adjusting the tax settings in WooCommerce to round at the subtotal level, store owners can ensure consistency between their calculations and those of their accounting software, thus avoiding complications caused by minor rounding errors and improving overall transaction efficiency.

For additional support with WooCommerce issues or help with integrating it with Zoho Books, QuickBooks, Odoo, or other accounting systems, consider seeking professional advice. Expert help in API or custom plugin integration can provide effective solutions without the costly fees associated with subscription-based services.

![How To Use Yoast SEO On WordPress [Complete Tutorial] Yoast SEO](https://www.hawkdive.com/media/Untitled-design-39-218x150.jpg)