Artificial intelligence (AI) is becoming an indispensable component in the financial services industry (FSI). With a staggering 91% of companies in the sector integrating AI technologies, these innovations are significantly enhancing operational efficiency, fostering customer satisfaction, and driving unprecedented levels of innovation. One of the standout technologies in this domain is Generative AI, which leverages NVIDIA NIM microservices and accelerated computing to elevate portfolio optimization, fraud detection, customer service, and risk management.

A few cutting-edge companies, such as Ntropy, Contextual AI, and NayaOne—all members of the NVIDIA Inception program—are leading the charge in employing these advancements to improve financial services applications. Additionally, Securiti, a startup based in Silicon Valley, is making waves with its centralized, intelligent platform designed for the secure use of data and generative AI, using NVIDIA NIM to construct an AI-powered copilot tailored for financial services.

At the prestigious fintech conference, Money20/20, taking place in Las Vegas, these companies are showcasing how their technologies can convert complex and diverse data into actionable insights. This allows banks, fintech companies, payment providers, and other organizations to seize new opportunities for advanced innovation.

### Ntropy: Organizing Unstructured Financial Data

Ntropy, based in New York, is tackling the issue of entropy—defined as disorder or randomness—within financial services workflows. As Naré Vardanyan, co-founder and CEO of Ntropy, describes, “Whenever money is transferred from one point to another, it leaves a trail in bank statements, PDF receipts, and other transaction history forms. Traditionally, this unstructured data has been challenging to organize and utilize for financial applications.”

Ntropy’s transaction enrichment application programming interface (API) addresses this by standardizing financial data from various sources and geographies. This API essentially acts as a universal language, enabling financial services applications to comprehend any transaction with near-human accuracy in mere milliseconds, all while reducing costs by a factor of 10,000 compared to traditional methods.

Built on the Llama 3 NVIDIA NIM microservice and the NVIDIA Triton Inference Server, which runs on NVIDIA H100 Tensor Core GPUs, Ntropy has achieved up to 20 times better utilization and throughput for its large language models (LLMs) compared to running native models. A notable beneficiary of this technology is Airbase, a leading procure-to-pay software platform provider, which enhances transaction authorization processes using LLMs and Ntropy’s data enrichment capabilities.

During Money20/20, Ntropy will demonstrate how its API can cleanse customer merchant data, improving the accuracy of risk-detection models and thereby enhancing fraud detection. This improvement reduces both false transaction declines and potential revenue loss. Another demonstration will feature an automated loan agent using the Ntropy API to analyze information on a bank’s website, generating a relevant investment report to expedite loan dispersal and decision-making processes.

### Contextual AI: Pioneering Retrieval-Augmented Generation in FSI

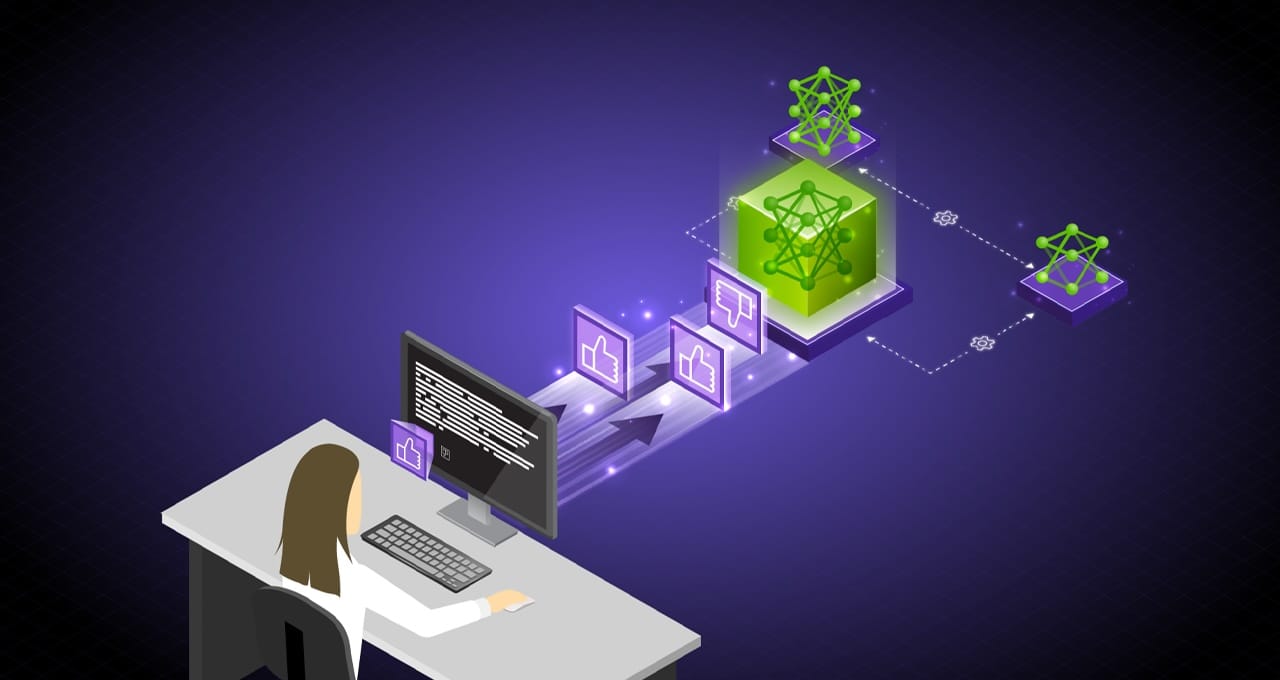

Contextual AI, headquartered in Mountain View, California, offers a robust AI platform powered by retrieval-augmented generation (RAG), ideal for developing enterprise AI applications in knowledge-intensive FSI scenarios. As Douwe Kiela, CEO and co-founder of Contextual AI, explains, “RAG is the key to delivering enterprise AI into production. By utilizing NVIDIA technologies and large language models, the Contextual AI RAG 2.0 platform can deliver accurate, auditable AI to FSI enterprises looking to optimize operations and introduce new generative AI-powered products.”

The Contextual AI platform integrates the entire RAG pipeline—spanning extraction, retrieval, reranking, and generation—into a single optimized system that can be deployed within minutes. This system can be further tuned and customized based on customer needs, providing significantly higher accuracy in context-dependent tasks.

For instance, HSBC plans to employ Contextual AI to offer research insights and process guidance support by retrieving and synthesizing pertinent market outlooks, financial news, and operational documents. Other financial entities are also leveraging Contextual AI’s pre-built applications for financial analysis, policy-compliance report generation, and resolving financial advice queries.

A practical example involves a user inquiring, “What’s our forecast for central bank rates by Q4 2025?” The Contextual AI platform would deliver a concise explanation accompanied by an accurate answer based on factual documents, complete with citations to specific sections in the source material.

The Contextual AI platform utilizes the NVIDIA Triton Inference Server and the open-source NVIDIA TensorRT-LLM library to accelerate and optimize LLM inference performance.

### NayaOne: Innovating with a Digital Sandbox for Financial Services

NayaOne, located in London, offers an AI sandbox that enables customers to securely test and validate AI applications before their commercial deployment. This technology platform empowers financial institutions to create synthetic data and provides access to a marketplace featuring hundreds of fintechs.

Within the digital sandbox, customers can benchmark applications for fairness, transparency, accuracy, and other compliance measures, ensuring optimal performance and successful integration. As Karan Jain, CEO of NayaOne, states, “The demand for AI-driven solutions in financial services is accelerating. Our collaboration with NVIDIA allows institutions to leverage the power of generative AI in a controlled, secure environment. We’re creating an ecosystem where financial institutions can prototype faster and more effectively, leading to genuine business transformation and growth initiatives.”

By utilizing NVIDIA NIM microservices, NayaOne’s AI Sandbox facilitates exploration and experimentation with optimized AI models, streamlining deployment. With NVIDIA accelerated computing, NayaOne achieves up to 10 times faster processing for the extensive datasets used in its fraud detection models, all while reducing infrastructure costs by up to 40% compared to CPU-based models.

The digital sandbox also employs the open-source NVIDIA RAPIDS suite of data science and AI libraries to boost fraud detection and prevention capabilities in money movement applications. NayaOne will showcase its digital sandbox at the NVIDIA AI Pavilion during Money20/20.

### Securiti: Enhancing Financial Planning with an AI Copilot

Securiti’s flexible Data+AI platform powers a wide array of generative AI applications, including safe enterprise AI copilots and LLM training and tuning, enabling users to construct secure, end-to-end enterprise AI systems. The company is currently developing an NVIDIA NIM-powered financial planning assistant, an AI copilot chatbot that accesses diverse financial data while upholding privacy and entitlement policies to deliver context-aware responses to users’ finance-related queries.

As Jack Berkowitz, Chief Data Officer at Securiti, notes, “Banks face challenges in providing personalized financial advice at scale while maintaining data security, privacy, and compliance with regulations. With robust data protection and role-based access for secure, scalable support, Securiti helps build safe AI copilots that offer personalized financial advice tailored to individual goals.”

The chatbot retrieves data from various sources, including earnings transcripts, client profiles, account balances, and investment research documents. Securiti’s solution securely ingests and prepares this data for use with high-performance, NVIDIA-powered LLMs, while preserving controls such as access entitlements. Ultimately, it delivers customized responses through a user-friendly interface.

By employing the Llama 3 70B-Instruct NIM microservice, Securiti has optimized LLM performance while ensuring data security. The company will demonstrate its generative AI solution at Money20/20.

NIM microservices and Triton Inference Server are accessible through the NVIDIA AI Enterprise software platform. To delve deeper into AI for financial services, join NVIDIA at Money20/20, running through Wednesday, October 30. Additionally, explore a new NVIDIA AI workflow designed for fraud detection.

For more Information, Refer to this article.